CLAIM: KPMG Identifies Zimbabwe as Top Investment Destination in Sub-Saharan Africa

SOURCE: The Zimbabwe Mail

VERDICT: False

The Zimbabwe Mail, an online publication, on 5 June 2024, carried the headline: ’KPMG Identifies Zimbabwe as Top Investment Destination in Sub-Saharan Africa’. The story cites the audit firm’s latest report: ‘Doing Deals in Sub-Saharan Africa’.

Carried out during the second half of 2022, the study surveyed 150 C-suite-level (senior executives) and other senior executives based on their experience in deal-making in Sub-Saharan Africa (SSA) over the past four years. The respondent group was divided equally between domestic investors (i.e., based in SSA) and international investors (i.e., based outside of SSA).

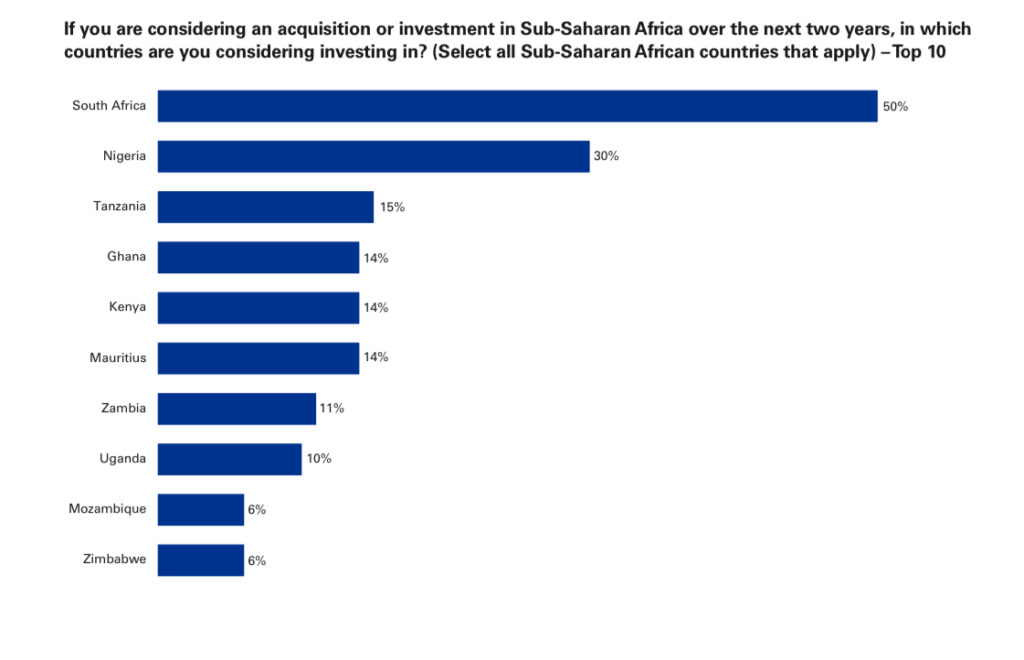

Responding to the question: ‘If you are considering an acquisition or investment in Sub-Saharan Africa over the next two years, in which countries are you considering investing in? (Select all Sub-Saharan African countries that apply), 6 percent of the respondents chose Zimbabwe, together with Mozambique (also at 6 percent), placing them in the top 10 preferred investment destinations.

South Africa at 50 percent and Nigeria at 30 percent are the leading Sub-Saharan Africa’s most preferred investment destinations according to the KPMG study.

Other data

There are various surveys and reports on investment opportunities for African countries. These give different results.

According to EY’s Africa Attractiveness Report 2023, Zimbabwe is second to South Africa in the top five list of Southern African countries that attracted the most investment projects in 2022. South Africa is leading with 157 projects followed by Zimbabwe (14 projects). The report ranks Zimbabwe ninth on the continent.

However, the Nomad Capitalist’s list of 10 African countries with investment opportunities, excludes Zimbabwe, placing Southern Africa’s Botswana and Mauritius ahead . Of the 10 listed countries, eight are in SSA and these are South Africa, Rwanda, Botswana, Ghana, Mauritius, Cote d’Ivoire, Kenya, and Tanzania. The remaining two are Egypt and Morocco which are not part of the SSA.

The Absa Africa Financial Markets Index (AFMI) is considered a useful tool for assessing the investment attractiveness of African countries. It measures progress in the development of capital markets and provides individual countries with guidance on how to attract international investment.

In its list of 28 countries, Zimbabwe is ranked at 18. It ranks behind 6 of its neighbours.

Conclusion

The claim as stated in the article headline: ‘KPMG Identifies Zimbabwe as Top Investment Destination in Sub-Saharan Africa’ has been rated as false in that the KPMG report does not place Zimbabwe as top investment destination but at number 10. The report, as correctly stated in the body of the article, includes Zimbabwe in the list of top 10 countries for future investments.

However, some other data sources give different results to the KPMG report, rendering the evidence inconclusive on whether Zimbabwe is in the top 10 African countries with future investment opportunities or not.